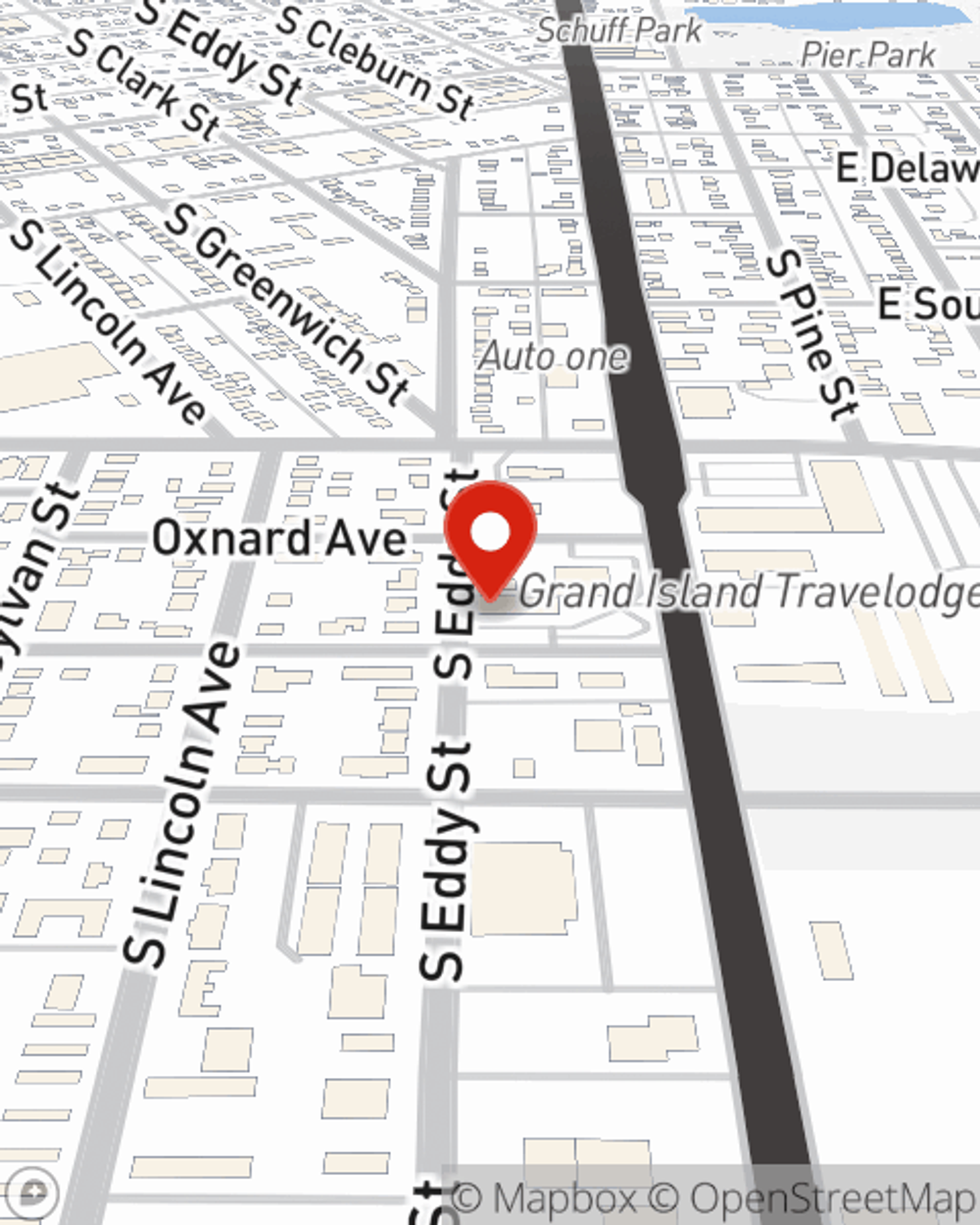

Business Insurance in and around Grand Island

Looking for small business insurance coverage?

Insure your business, intentionally

- Grand Island

- Wood River

- Alda

- Phillips

- Doniphan

- St. Libory

- Chapman

- Worms

- Palmer

- Giltner

- Juniata

- Cario

- Archer

- Silver Creek

- Clarks

- Dannebrog

- Elba

- Farwell

- Wolbach

- Cushing

- Kenesaw

- Prosser

- Ayr

- Holstein

Help Protect Your Business With State Farm.

Running a business is about more than making a profit. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for everyone you care for. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, errors and omissions liability and a surety or fidelity bond.

Looking for small business insurance coverage?

Insure your business, intentionally

Get Down To Business With State Farm

Whether you own a pizza parlor, a farm supply store or an antique store, State Farm is here to help. Aside from outstanding service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Melissa Reed today, and let's get down to business.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Melissa Reed

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.